CREATING RISK INTELLIGENT PROFESSIONALS

Frequency of Class

6 days a week (for 1 year)

Programme Hours

640 Hours (40 Hours / paper)

Focus of Programme

Understanding different facets of Risk Management

Eligibility

Graduate with minimum 50% score

1) Business Value Chain and Operating models

2) Process Mapping, Enhancement and Value Stream Mapping

3) Process Assurance and Operating Efficiency – Part I

4) Process Assurance and Operating Efficiency – Part 2

5) Concepts of Enterprise Risk Management (‘ERM’)

6) Organisational Behavior

7) Strategic Thinking

8) Sectorial View of ERM

1) Internal Controls over Financial Reporting (‘ICFR’ or ‘Sarbanes Oxley’ or Internal Financial Controls)

2) IT General Controls

3) Applied Cyber Security

4) Applied Data Analytics

5) Fundamentals of HRM

6) Market, Credit & Operational Risk

7) Regulatory & Compliance Risks

8) Digitalization – Evolving Risk Management

9) Third Party Risk Management (TPRM)

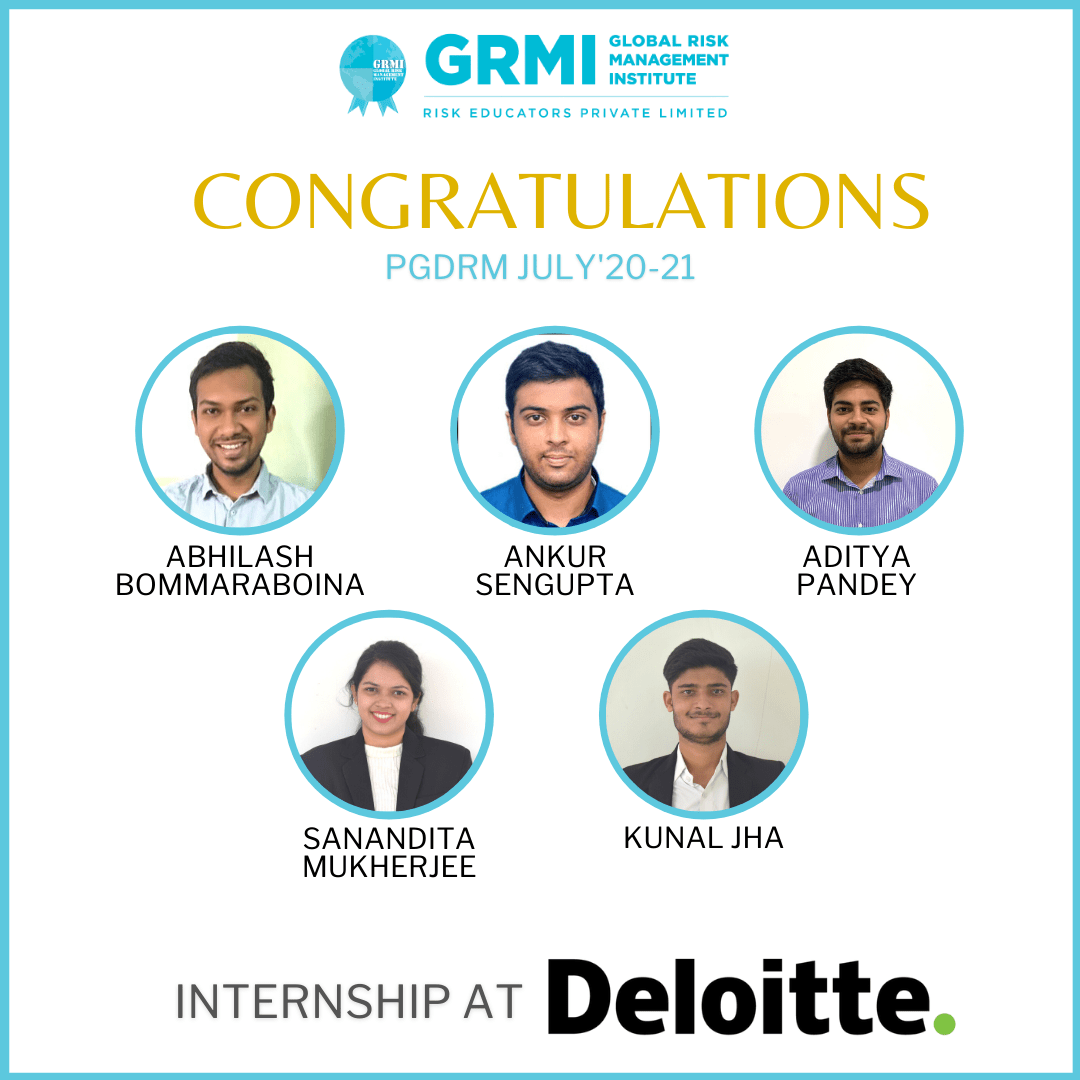

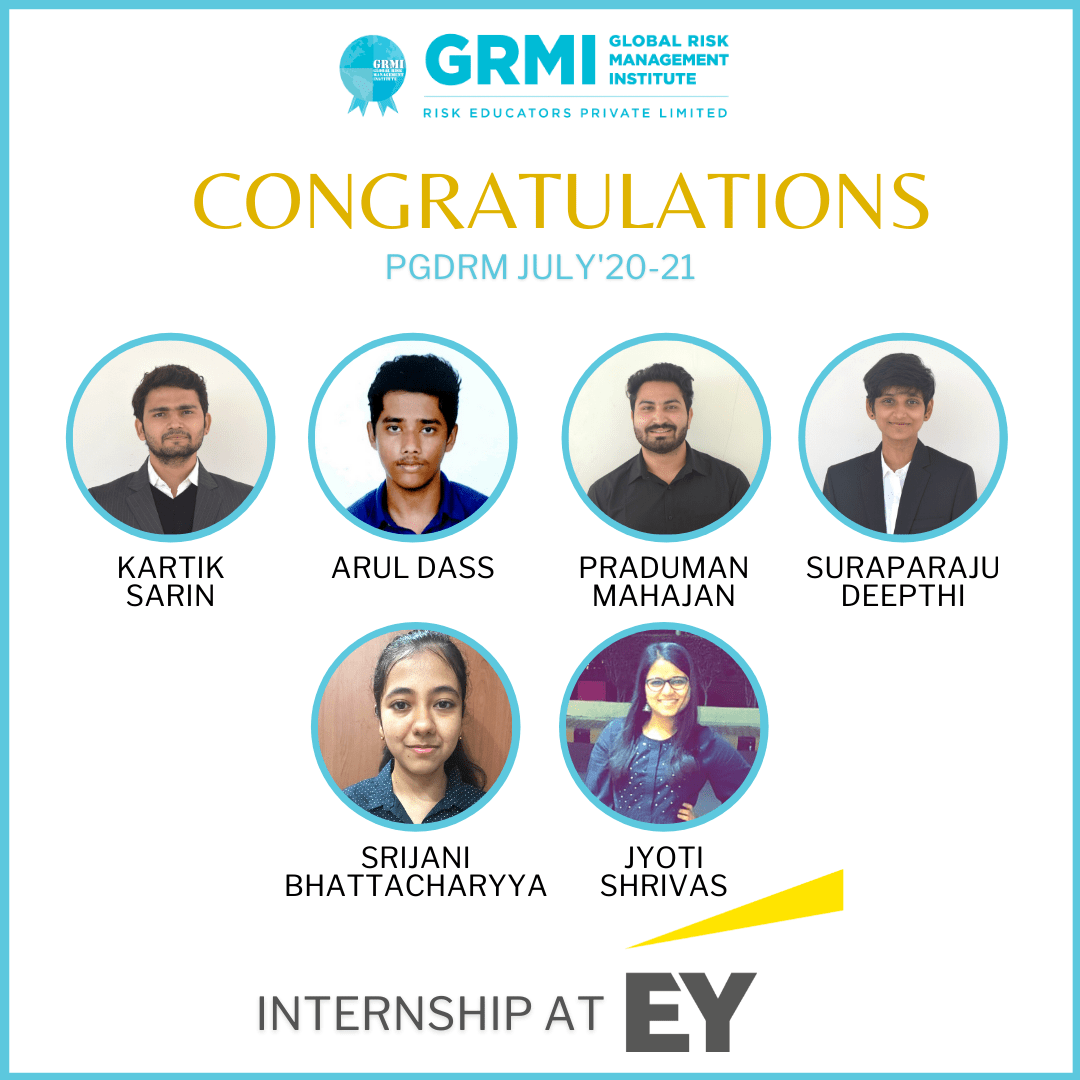

PGDRM-1 year programme included 6-8 weeks of guaranteed* internship.

Only institute in the world to cover all aspects of Risk Management.

Learn from business leaders and enjoy 2X Career Growth enhancement.

The curriculum has a strong component of real-life case studies and the course content is tailored to create risk domain experts.

PGDRM is endorsed by UK Accreditation body-OTHM, which is accepted Globally.

Certification acknowledged by industry partners like the Institute of Internal Auditor (IIA)

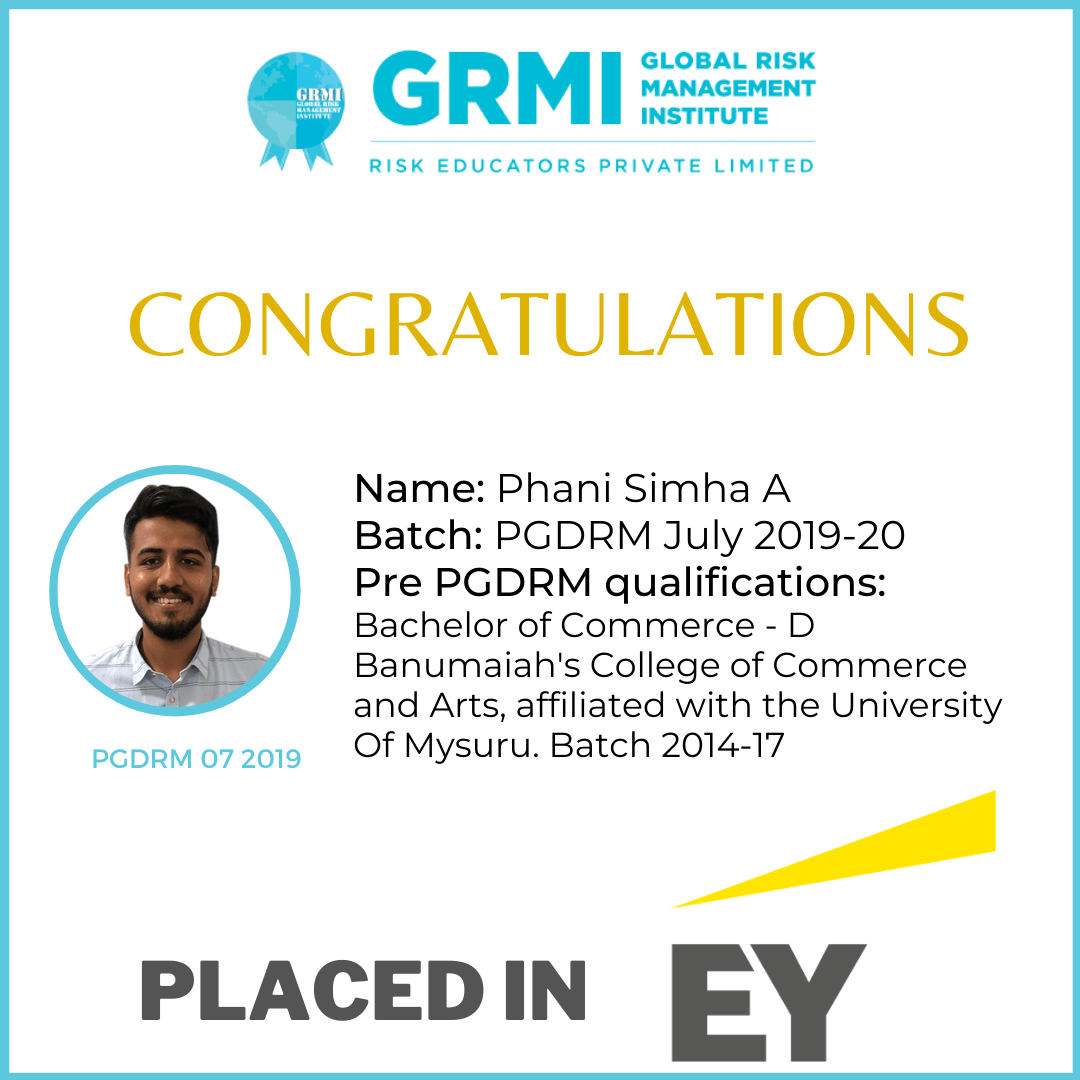

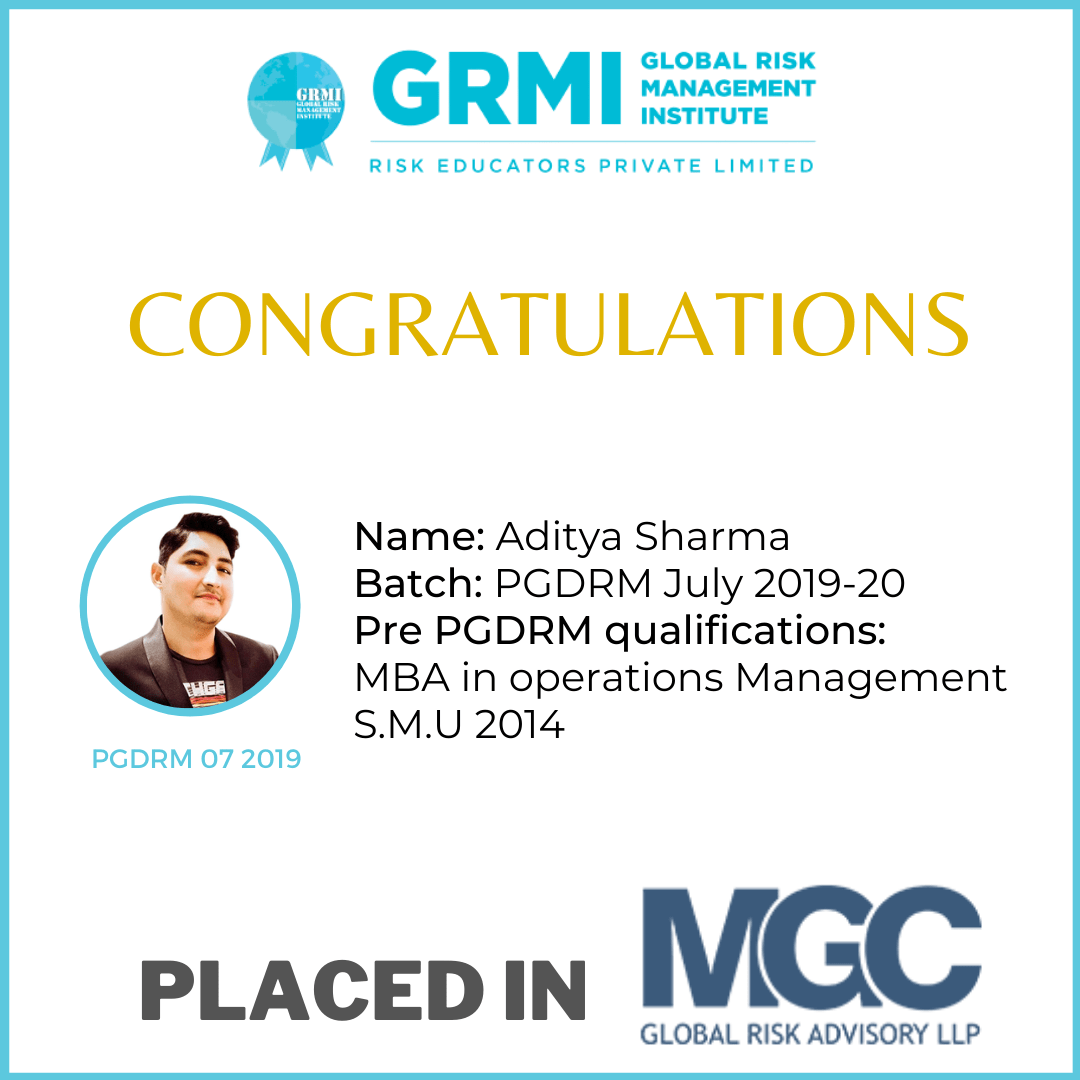

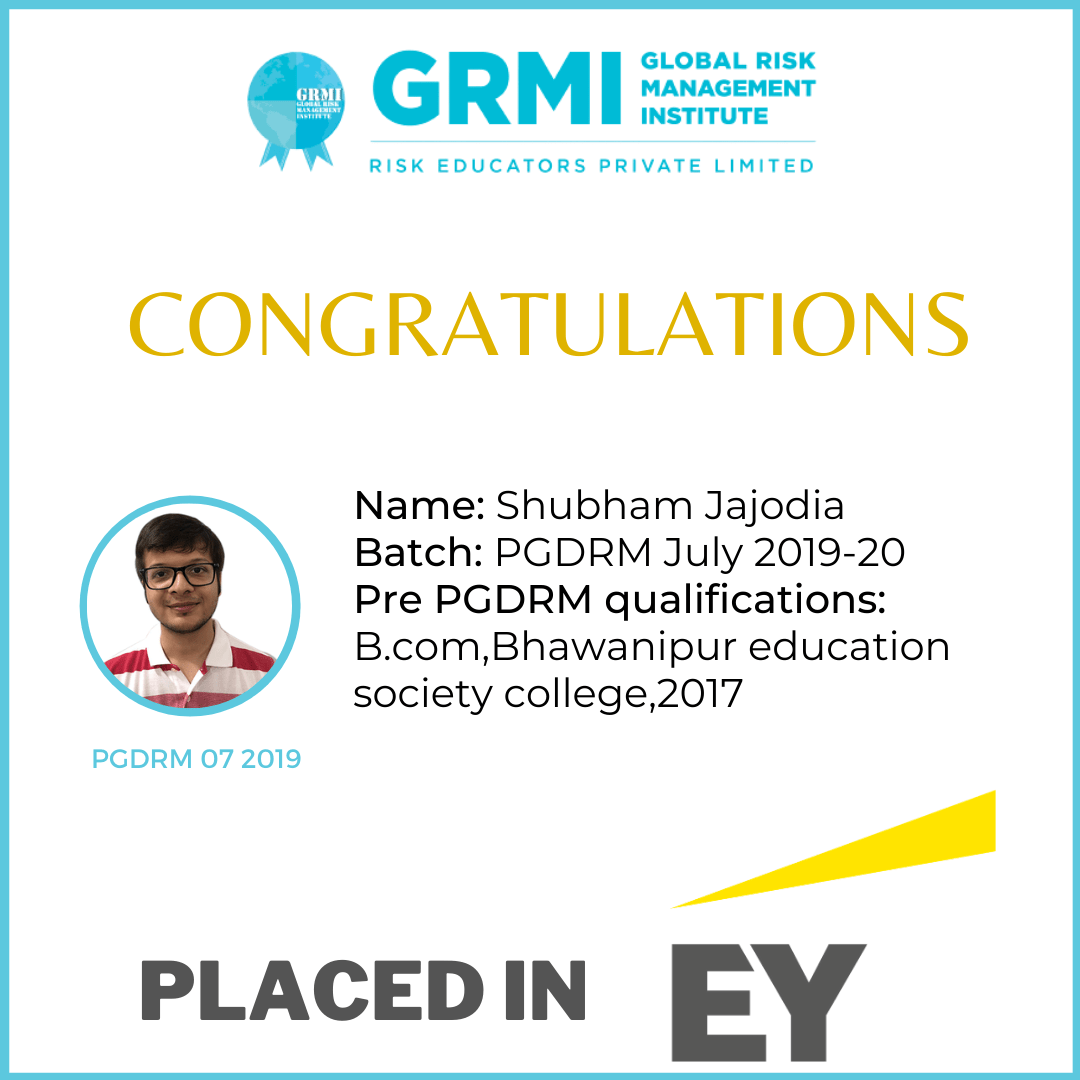

100% Placement guaranteed*– Past placement firms: EY, KPMG, Grant Thornton.

6-8 week guaranteed internship.

(PGDRM YEAR 2020-21: 100% Internship and Placements)

WHAT PGDRM ALUMNI AND STUDENTS HAVE TO SAY?

-INDRA KIRAN KARUKURI

PGDRM 2017-18

Works at Protiviti,

Middle East

-YASHI RAI

PGDRM 2019

Works at PwC

Any graduate with minimum 50% score in graduation (0-4 years of work experience) and interest in Risk Management can opt for this course.

-PGDRM covers all aspects of Risk Management.

-It is a 1 year full time on-campus course.

-100% placements guaranteed*.

-6-8 weeks of internship guaranteed.

PGDRM at GRMI is endorsed from a UK Accreditation body which is accepted Globally.

OTHM is a UK Awarding Body regulated by Ofqual (Office of the Qualifications and Examinations Regulations) and recognised by Qualifications Wales.

1)Enquiry: Fill the enquiry form for PGDRM on our website. You will receive an automated email with details of the Programme, Brochure etc. (Note: Incomplete forms will not be considered). Please do check your spam box if the email does not fall in your inbox automatically.

As a specialised institute, we recognise the need of multidisciplinary approach in the ever evolving arena of risk management required to work together with other centres of risk expertise around the world.

We have created a curriculum that spans across all aspects of enterprise risk, financial, operational and compliance, and provides nuanced insights across all key industry verticals.