1-Year PG Diploma in Technology

Risk Management

Specialized Course in Cybersecurity & IT Risk Management | 6 Months Classroom + 6 Months Paid Internship

79% of business executives believe that keeping up with the speed of digital is a significant risk management challenge. (PwC 2022 Global Risk Survey)

33% of respondents considered outsourcing cybersecurity risks. (KPMG 2023 Chief Risk Officer Survey)

Cybersecurity alone can account for 10% of total IT spending. (McKinsey & Company Article)

Cyber attack or data breach is the top business risk for India. (Aon Plc’s 2023 Global Risk Management Survey)

What is PGDTRM?

The Post Graduate Diploma in Technology Risk Management (PGDTRM) is a 1-year full-time program in IT Risk Management and Cyber Security, offered by NU University in partnership with Global Risk Management Institute (GRMI). The course includes 6 months of on-campus learning and a 6-month paid internship, giving students both strong academic foundations and real-world exposure. Designed for graduates and professionals, this specialized diploma builds expertise in cyber security, IT governance, data protection, and enterprise risk management, preparing learners for high-demand careers in technology and risk management.

Overview of Technology risk management

Introduction to IT controls and type of IT controls

Introduction to IT controls and type of IT controls

ITGC domains overview

Data center and network operations controls

SOC1 / SOC2 / SOC2 reports

Change management controls

Applied Cyber Security - Introduction

Data Loss Prevention (DLP)

NIST, ISO 27001 and COBIT Framework

Why Choose PGDTRM

Master a Fast-Growing Domain

Build expertise in Technology Risk Management

Learn from Top Institutions

A joint program by

NU & GRMI

Taught by Industry Experts

Get trained by real-world practitioners

Strong Placement Track Record

Backed by successful alumni from NU & GRMI

6-Month Paid Internship

Gain hands-on experience before you graduate

PGDTRM Advantage

Eligibility

Graduates from any background, 0–4 years of experience

Learning Hours

410 hours total

180 hours teaching

80 hours projects

Internship

6-month paid internship Real projects Industry experience

Salary Potential

INR 6–8 LPA Performance-based Internship driven

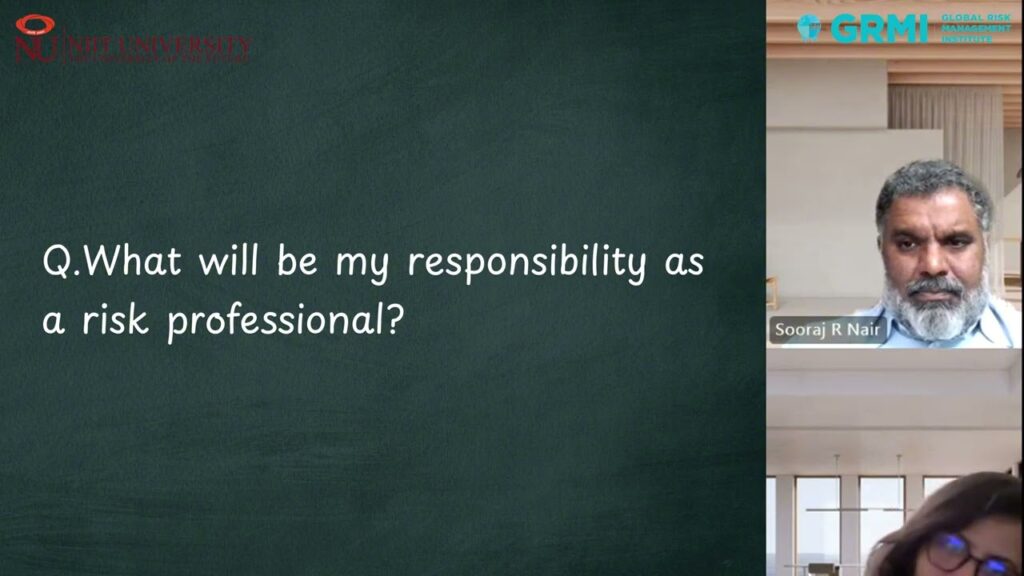

Expert Insights

Job Roles Offered After PGDTRM

Technology Risk Management

Risk Advisory: Cyber IOT Security

Risk Advisory: Detect & Respond

Risk Advisory: Data Privacy

Risk Assurance

Digital Trust IT Audit

Risk Advisory: Accounting & Internal Controls: ITSA

Risk Advisory: Internal Audit Analyst

Purpose

- Equip students with in-depth knowledge and practical skills in technology and risk management.

- Enable businesses to effectively integrate technology into growth strategies, addressing the challenges of increasing digitalisation.

- Prepare students to manage technology-related risks such as cybersecurity threats and data privacy concerns.

- Support organisations in expanding and upskilling risk management teams to meet evolving business needs.

- Develop a new generation of technology risk specialists to meet growing global demand.

- Leverage the combined strengths of NU’s IT expertise and GRMI’s risk management leadership through a comprehensive, industry-relevant curriculum.

Rankings

Ranked #2 in Rajasthan State IIRF Ranking 2022 for excellence in academics and innovation.

Awarded University of the Year (North) at the Indian Education Congress & Awards 2020.

Ranked #12 in North Zone IIRF Ranking 2022 for outstanding education and research performance.

Among India’s Top 10 Private Engineering & Technology Universities by Education World Ranking 2022–23.

Winner of the TERI Water Sustainability Award under the Domestic Water Users category.

Awarded Greenest Campus in the Country for sustainable initiatives and eco-friendly infrastructure.

PGDTRM Potential Recruiters

Learn From Experts

Admission Process

Submit Enquiry

Enquiry: Fill the enquiry form for PGDTRM (Post Graduate Diploma in Technology Risk Management) on our website. You will receive an automated email with the programme brochure, details, and next steps. (Note: Incomplete forms will not be considered.) Please check your spam folder if the email does not appear within a few minutes.

Eligibility: Candidates must hold a Bachelor’s degree or an equivalent qualification in any discipline, with at least 50% aggregate marks (or equivalent grade), from a recognised university in India or abroad (recognised by the UGC / Association of Indian Universities). The degree should include a minimum of three years of education after higher secondary schooling (10+2 system) or equivalent. Candidates are strongly encouraged to complete all academic requirements before joining to manage the rigorous curriculum and internal assessments effectively.

Complete Application & Counselling Support

Assessment & Personal Interview

Aptitude Test: The test will be of 60 minutes and will cover business communication, logical reasoning, basic risk-related concepts, and questions from the technology domain. Candidates who successfully clear this round will proceed to the personal interview stage.

Personal Interview (PI): The personal interview will be conducted by a panel of academic and corporate experts from NU and GRMI, specialising in the Technology Risk domain. The result of this round will be shared with candidates within one week of the intervie.

Programme Commencement

The programme commences in February each year.

Fee & Payment Mode

| Particulars | Time of Payment | Amount (INR) | Remarks |

|---|---|---|---|

| Application Payment | Application Form | ₹2,000 | This amount will be adjusted against the Sem 2 fees upon successful enrolment into the programme. |

| Security Deposit | 7 days from receiving offer | ₹20,000 | The security deposit of INR 20,000 is a caution fee and is refundable ONLY upon the completion of the programme. It will be credited to the student's account after convocation. This security deposit/ caution fee is non-refundable in case the student does not enrol into the programme. |

| Semester I Fees - Tution Fee | 22 days from offer i.e. 7+15 from offer | ₹450,000 | |

| Semester II Fees - Tution Fee | 90 days from start of the programme | ₹448,000 | |

| Total | ₹920,000 | ||

| Less: Refundable Deposit | ₹(20,000) | Refundable security deposit upon successful enrolment into the programme | |

| Grand Total | ₹900,000 |

The above fee structure is applicable for all Indian national students who are residing in India. For any non-resident Indian or foreign national please contact us for details of our fee structure.

The above fee does not include the Hostel Fees of INR 162,000/-

Student Placement Section

Rajnish Pathak

LinkedIn: Click Here

Educational: BACHELORS IN COMMERCE (HONS.) (APRIL 2019 – MARCH 2021), Calcutta University

Experience: Guha& Matilal (CA Firm) - Internship, (AUG’23 – SEP’24

Placement: Intern, IT, Data & Analytics Department , Deloitte

Perla Maheshwara Reddy">

Perla Maheshwara Reddy">

Perla Maheshwara Reddy

LinkedIn: Click Here

Educational: B.TECH IN CIVIL ENGINEERING (2020-2023), ANNAMACHARYA INSTITUTE OF TECHNOLOGY AND SCIENCES

Experience: Onsite Support Engineer Genpact (Payroll: Quess), Hyderabad (May 2024 – Jun 2024), Technical Support Engineer Network & Desktop (Freelance) Innovative Digitech Services Bengaluru, Jan 2023 – Dec 2023

Placement:Audit and Assurance - IT Data & Analytics

Pranjal Singh

LinkedIn: Click Here

Educational Background: B.COM (2016-2019) SCHOOL OF MANAGEMENT SCIENCES VARANASI

Experience: FRESHER

Placement: Intern, IT, Data & Analytics Department , Deloitte

Vishal Shyama

LinkedIn: Click Here

Education: BTECH COMPUTER SCIENCE (2020), SRM UNIVERSITY

Experience: ATOS QA Engineer (Software Testing) (May 2021-March 2024) Chennai, India

Placement: Associate Consultant in Business Consulting Risk, EY

Abhay Shukla

LinkedIn: Click Here

Education: BSC Hons Applied Mathematics (2022) , JAMIA MILIA ISLAMIA UNIVERSITY

Experience: FRESHER

Placement: Intern, Controls Assurance Department , Deloitte

Anudeep Reddy

LinkedIn: Click Here

Education: B.COM (Computer Applications) (AUG’20 - JUNE’23) , Osmania University

Experience: WIPRO- FRAUD ANALYST, (NOV’23 - OCT’24)

Placement: Intern, Controls Assurance Department , Deloitte

Suman Maji

LinkedIn: Click here

Education: B.COM in Finance and Accounting (2016-2019), Calcutta University

Experience: Relationship manager ICICI BANK LTD, Kolkata (JAN 2021-MAY 2024); Branch Development manager SBI General Insurance Company, (Kolkata)

Placement: Intern, Controls Assurance Department , Deloitte

FAQ's - Expert Insights

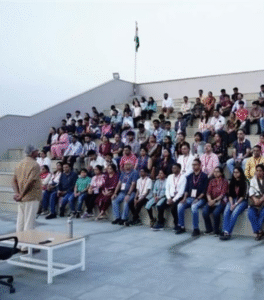

About NU

The UNIVERSITY that makes a difference

NU is dedicated to exploring new knowledge frontiers through industry links, technology, and research-driven, seamless education. Aiming to be a leading innovation and learning center, we focus on deep industry connections and a strong research culture from day one. Attracting and retaining top faculty in a stimulating environment is key, with internationally renowned advisors and founding professors inspiring our community

About GRMI

Creating Risk Intelligent Professionals

As a specialised institute, we recognise the need of multidisciplinary approach in the ever evolving arena of risk management required to work together with other centres of risk expertise around the world. We have created a curriculum that spans across all aspects of enterprise risk, financial, operational and compliance, and provides nuanced insights across all key industry verticals. GRMI offers 1 year full time on-campus PGDRM programme-Post graduate diploma in Risk Management.