Digital Arrest Scam: Real Incidents, Concerns, Challenges and Way Forward

- Posted by GRMI

- Categories Blog, pgdrm blog

- Date January 19, 2026

- Comments 0 comment

Digital Arrest Scam: Real Incidents, Concerns, Challenges and Way Forward

In India’s rapidly expanding digital economy, cybercrime has evolved far beyond simple phishing emails and fake links. Fraudsters now deploy sophisticated psychological tactics that exploit fear, authority, and isolation to manipulate victims. One such emerging threat is the digital arrest scam, which has caused devastating financial and emotional losses across the country.

Unlike conventional cyber fraud, digital arrest scams do not rely solely on technical deception. Instead, they use impersonation of law-enforcement authorities to create panic and compliance. Victims are convinced that they are under legal investigation and face immediate arrest. Under intense pressure, many comply with unlawful demands to transfer large sums of money or disclose sensitive personal information.

Recent incidents in Delhi highlight how organised and dangerous these scams have become, affecting elderly citizens, NRIs, and individuals living alone.

What Is a Digital Arrest?

A digital arrest is a cyber fraud technique that relies on psychological confinement rather than physical detention. Criminals convince victims that they are officially under arrest or facing a serious criminal investigation.

Scammers impersonate officers from agencies such as the CBI, Narcotics Control Bureau, Customs Department, or Reserve Bank of India. They falsely accuse victims of crimes like money laundering, drug trafficking, or suspicious parcel movements.

Victims are told that a digital arrest warrant has been issued in their name. The threat of immediate arrest creates fear, confusion, and emotional distress.

To strengthen control, scammers force victims to remain on continuous video calls using platforms like Skype or WhatsApp. Victims believe they are under official surveillance throughout the investigation.

There is no physical custody. However, victims remain mentally confined through fear, isolation, and constant intimidation. This psychological captivity gives rise to the term digital arrest.

Why Are Digital Arrest Scams Becoming More Common in India?

Digital arrest scams exploit deep-rooted trust in law-enforcement authorities among the general public. Most victims fear legal consequences and hesitate to question official-sounding instructions.

Elderly individuals and people living alone face higher vulnerability due to emotional isolation. NRIs and families with overseas connections are frequently targeted due to perceived financial capacity.

Rapid growth in digital payments has made fund transfers easier and faster. This allows scammers to move stolen money across accounts before detection.

Cybercriminals also operate across international borders, making investigation and enforcement significantly more challenging for local authorities.

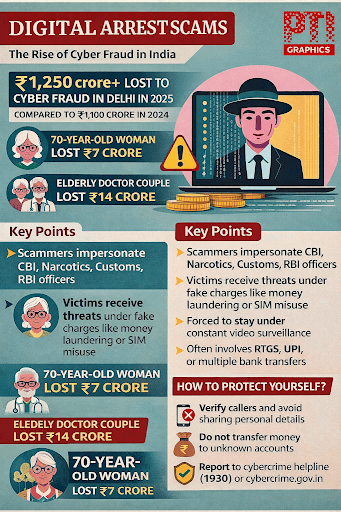

Case 1: ₹7 Crore Fraud on 70-Year-Old Woman

A 70-year-old woman in Greater Kailash was duped of ₹7 crore over eight days by scammers posing as police. They claimed her SIM was linked to money laundering, kept her under digital surveillance, and isolated her from family. She transferred ₹6.9 crore before the fraud was reported.

Case 2: ₹14 Crore Scam on Elderly NRI Doctor Couple

An NRI doctor couple from Greater Kailash lost nearly ₹14 crore after being held under “digital arrest” for over two weeks. Scammers impersonated law enforcement, threatening arrest and legal action through continuous calls. The scam was uncovered after calls suddenly stopped.

Challenges in Addressing Cyber Scams in India

Cyber scams such as digital arrests are difficult to address due to several structural and technological challenges. Some of them are given below as follows:

- Anonymity of cybercriminals:

Cybercriminals operate with high levels of anonymity, using VPNs, encrypted communication platforms, and identity-masking tools to hide their location and identity. - Cross-border nature of crimes:

Many digital arrest scams originate outside India, particularly from Southeast Asia and China, limiting the jurisdiction of local law enforcement agencies. - Rapidly evolving scam techniques:

Cyber fraud has evolved from simple phishing emails to advanced social engineering involving voice calls, video conferencing, and psychological surveillance. - Difficulty in detection:

The sophistication of these techniques makes scams difficult to identify, even for digitally aware and educated users. - Use of advanced malware:

Cybercriminals deploy malware capable of bypassing traditional antivirus software and firewalls to gain unauthorised access to devices. - Data theft and surveillance:

Such malware enables theft of sensitive personal and financial data, while allowing continuous monitoring of victim activity without detection.

Types of Cyber Scams Commonly Reported in India

Digital arrest scams form part of a broader ecosystem of cyber fraud affecting individuals and businesses across India.

- Phishing scams involve fake emails or messages designed to imitate trusted organisations. Victims are tricked into sharing passwords, banking details, or personal identification information.

- Lottery and prize scams falsely inform victims that they have won large rewards. Scammers demand processing fees or tax payments before releasing the supposed winnings.

- Emotional manipulation scams often operate through dating platforms or social media. Fraudsters build trust over time and later request money for emergencies, frequently demanding cryptocurrency transfers.

- Job scams target fresh graduates and job seekers through fake listings on employment portals. Victims are asked to pay registration fees or share sensitive personal details.

- Investment scams promise high and unrealistic returns through Ponzi or pyramid structures. These scams exploit financial aspirations and lack of investment awareness.

- Cash-on-delivery scams involve fake online stores delivering counterfeit or inferior products after accepting payment.

- Fake charity appeal scams use emotional narratives and fabricated causes to solicit donations through fraudulent websites or social media pages.

- Mistaken money-transfer scams pressure victims to return funds allegedly sent by mistake, supported by forged transaction receipts.

- Credit card and loan scams offer instant loans at low interest rates. After collecting upfront fees, the scammers disappear.

Key Government Initiatives to Combat Cyber Scams in India

The Indian government has launched several initiatives to strengthen cybercrime prevention and response mechanisms.

- The National Cyber Security Policy provides a framework for protecting digital infrastructure and improving cyber resilience.

- CERT-In (Computer Emergency Response Team – India) acts as the national nodal agency for responding to cybersecurity incidents and issuing alerts.

- The Cyber Surakshit Bharat Initiative focuses on building cybersecurity awareness and capacity among government officials and organisations.

- The Cyber Swachhta Kendra provides tools and information to detect and remove malicious software from infected devices.

- The National Critical Information Infrastructure Protection Centre (NCIIPC) safeguards critical sectors such as banking, telecom, and power systems.

- The Cyber Crime Coordination Centre improves coordination between central and state law enforcement agencies.

- The Citizen Financial Cyber Fraud Reporting and Management System enables faster reporting and fund-blocking in financial fraud cases.

Way Forward: Strengthening Digital Safety and Awareness

Digital arrest scams form part of a broader ecosystem of cyber fraud affecting individuals and businesses across India.

- Phishing scams involve fake emails or messages designed to imitate trusted organisations. Victims are tricked into sharing passwords, banking details, or personal identification information.

- Lottery and prize scams falsely inform victims that they have won large rewards. Scammers demand processing fees or tax payments before releasing the supposed winnings.

- Emotional manipulation scams often operate through dating platforms or social media. Fraudsters build trust over time and later request money for emergencies, frequently demanding cryptocurrency transfers.

- Job scams target fresh graduates and job seekers through fake listings on employment portals. Victims are asked to pay registration fees or share sensitive personal details.

- Investment scams promise high and unrealistic returns through Ponzi or pyramid structures. These scams exploit financial aspirations and lack of investment awareness.

- Cash-on-delivery scams involve fake online stores delivering counterfeit or inferior products after accepting payment.

- Fake charity appeal scams use emotional narratives and fabricated causes to solicit donations through fraudulent websites or social media pages.

- Mistaken money-transfer scams pressure victims to return funds allegedly sent by mistake, supported by forged transaction receipts.

- Credit card and loan scams offer instant loans at low interest rates. After collecting upfront fees, the scammers disappear.

To counter digital arrest scams, prevention must combine awareness, technology, and coordinated action.

India’s Prime Minister has outlined a simple three-step digital safety approach.

Stop: Remain calm when receiving threatening calls. Do not share personal or financial information immediately.

Think: Recognise that legitimate agencies do not conduct investigations or demand payments over phone calls.

Take Action: Report incidents to the National Cyber Crime Helpline (1930) or the Cyber Crime Reporting Portal.

From a cybersecurity perspective, individuals and organisations should implement firewalls to monitor and filter unauthorised network access. Regular software updates are essential to patch security vulnerabilities.

Enhanced security measures such as two-factor authentication and data encryption add critical layers of protection for financial and personal information.

Banks must remain vigilant by monitoring high-value transactions in low-balance or salaried accounts. Stolen funds are often routed through such accounts before conversion into cryptocurrency and transfer abroad.

Public awareness remains the strongest defence. Individuals should never share Aadhaar, PAN, or banking details over calls. Caller identities must always be verified through official channels.

International cooperation is equally vital. Shared intelligence, aligned legal frameworks, and coordinated enforcement can significantly weaken cross-border cybercrime networks.

For any queries, please fill out the form

You may also like

Career Scope After Completing a Diploma in Cybersecurity

Best Consulting Jobs for Freshers in India